Common Contingencies When Buying a Home

If you’re buying a home, here is information to help you understand what are contingencies.

Are you a first-time buyer wondering, “what are contingencies?”

Even if you are an experienced buyer aware of the answer to “what are contingencies,” you still need to know what contingencies are common in your market to prepare for your home purchase.

Here is an overview of what contingencies are in relation to buying a home.

What Are Contingencies?

Contingencies, or contingency clauses, are contract terms that are added to the negotiations and agreements of real estate transactions.

In order to close on the transaction, the outlined contingencies must be met. The purchase or sale of a home cannot happen until the agreed-upon contingencies have been fulfilled.

Even when the offer is accepted and the buyer and seller are at an agreement, either party has the opportunity to back out of the deal if the contingencies aren’t met.

Contingencies are a way that buyers and sellers can safeguard their interests and ensure that the transaction meets their needs — preventing either party from being locked into a deal that isn’t in their best interests.

Because of the security and negotiation leverage that contingencies offer buyers, it’s important to be familiar with popular contingencies that can be used as home buying strategies.

These are the five most common contingency clauses that buyers should be aware of as they approach their real estate transactions.

#1. Home Inspection Contingency

The home inspection contingency allows buyers to renegotiate their position when the results of the home inspection come back.

Based on the inspection, the buyer would be allowed to request specific repairs, adjust their purchasing price, or terminate the contract with protection from the contingency.

Any changes made to the initial agreement between the buyer and seller that occur due to the inspection contingency may impact the overall transaction. For example, if the inspection revealed an issue on the property and the buyer requests that the seller renovate before closing, that may delay the closing process.

Keep these details in mind and speak with your agent about how to best navigate the home inspection contingency once the inspection results are submitted.

#2. Home Appraisal Contingency

The home appraisal contingency secures the buyer’s position in case the results of the official property appraisal prove the home to be worth a different amount than what was offered and agreed upon by the buyer and seller.

If the home is appraised to be valued at a different price — either higher or lower — than the offer price, that may impact the buyer’s ability or desire to close on the home.

The home appraisal contingency allows buyers to terminate the deal based on the results of the home appraisal.

#3. Title Contingency

The title contingency protects the buyer’s position in case the title company identifies issues with the property’s title.

Problems with the home’s official ownership record may impact the transaction. In case the title company discovers unpaid liens on the home, buyers with title contingencies can safely back out of the transaction if needed.

If there are title issues, they may be able to be resolved by attorneys or the title company. However, this may impact the overall transaction by delaying closing, so buyers will want to protect their interests so they can make the best choice based on the situation.

#4. Home Sale Contingency

Buyers who are selling their previous homes to buy a new home will need to add a home sale contingency to safeguard their interests.

In these cases, buyers will likely be depending on the income from the sale of their previous home to fund the purchase of their new homes.

Buyers who have made an offer on a new home and are waiting for their previous home to sell will be protected by the home sale contingency in case an issue arises with the sale of their previous home. The buyer will be able to back out of or adjust the deal for their new home accordingly.

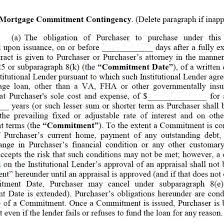

#5. Mortgage Contingency

The mortgage contingency allows buyers to back out of their purchasing agreements in case an issue arises with their financing. If the buyer is unable to secure a mortgage loan from a lender, the mortgage contingency will offer them protection to avoid fees or other penalties from backing out of the deal.

Talk to Your Top Agent About Other Necessary Contingencies

Even when you know “what are contingencies,” you still need to work with a top agent.

Outside of these five common contingencies, you may want to add contingency clauses that reflect a specific condition of the listing or your position as a buyer. For example, you may request termite verification or additional property inspections as needed.

When you work with a top agent in your area, they will be able to recommend strategic contingencies to protect your interests as a buyer.

To learn more about the home buying process and answer questions like “what are contingencies,” click here for more articles from RealEstateAgents.com.