What Credit Score Do You Need to Buy a House?

Curious about the requirements for your credit score to buy a house? Lenders look for scores above 620, but buyers have options to accommodate scores.

Thoughts of buying a new home with a mortgage on your mind? Your first step should be checking on your credit score. When looking at your credit score to buy house, you’ll want to determine what the target credit score is for buying a home in today’s market.

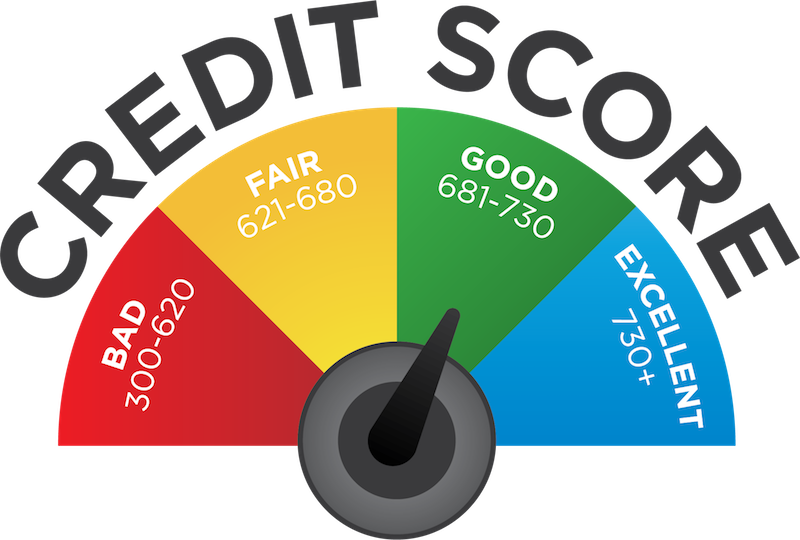

When applying for a mortgage to finance your new home, your credit score directly relates to your borrowing potential. Ranging from very poor at 300 to excellent at 850, lenders reference credit scores when underwriting home loans. Lenders use an applicant’s credit history, most often from their FICO® scores, to calculate their mortgage terms, such as interest rates and qualifying loan packages.

Credit Scores and Interest Rates in 2021

To support the housing market throughout the pandemic, mortgage rates were dropped to historic lows in 2020.

In 2021, the interest remains low with the rate at 2.98% on a 30-year mortgage through the week of July 1, 2021. With the average rates so low, the effect that a borrower’s credit score has on their loan’s interest rate is significantly less than what was seen in other market conditions. However, buyers still want to strive toward healthy credit scores to land other favorable loan terms beyond an affordable interest rate.

According to Ellie Mae, the average FICO score upheld by borrowers in 2020 on all loan types rose to 753. The 2020 rates were approximately 20 points higher than data from 2019, representing that today’s buyers are paying more attention to the relationship between credit scores and favorable loan options.

Credit Score to Buy House Varies by Loan Type

What credit score do you need to qualify for a strong mortgage loan and purchase a home?

While lenders do use credit scores as a primary indicator of a borrower’s potential as a long-term client, mortgage underwriting is a complex process. There are numerous other factors, including annual income, debt-to-credit ratios, property type, location, and market rates, that are considered during a loan’s underwriting.

There’s no single credit bracket that buyers need to meet in order to qualify for a mortgage. There are loan options available to accommodate almost any credit score.

Different loan packages have different credit score requirements. Credit scores define a borrower’s access to beneficial terms through different loan types. For example, the mortgage package a lender offers will establish your minimum required down payment — and in 2020, 11% of buyers reported that saving for the down payment was the most difficult part of the entire buying process.

How much you pay for your home, both upfront at closing and throughout the lifetime of your loan, is set by your credit score.

These are the required credit scores to buy houses using conventional, jumbo, VA, and FHA loans.

Conventional Loans Require 620 and Above

For a conventional mortgage from a private lender, the lowest qualifying credit score to buy house is 620. However, borrowers typically need scores above the minimum to qualify for conventional loans with preferred terms. Higher credit scores give borrowers access to benefits such as lower costs for PMI and down payment requirements.

Jumbo Loans Require 680 and Above

Unlike conventional loans which have a purchasing limit for the financed property’s price tag, jumbo loans let buyers purchase higher-priced listings. These loans are fitting for buyers shopping for luxury real estate or homes located in dense metropolitan areas. Because these loans are used to fund homes over $510,400, lenders require borrowers to maintain scores of at least 680 with accompanying proof they can afford to pay back the loan.

FHA Loans Require 500 to 580 and Above

Backed by the Federal Housing Administration, FHA loans are flexible mortgages options that accommodate borrowers with credit scores in the 500’s. FHA loan packages offer low down payment requirements, but the amount you’re required to pay depends on your credit score. Borrowers with credit scores above 580 may pay as little as 3.5% down, whereas scores between 500 and 580 require 10% down.

VA Loans Have No Minimum Score

Unlike other loan types, veterans can qualify for loans with no minimum score with VA-backed loans. However, VA loans are underwritten by private lenders which may uphold their own credit minimums. For example, QuickenLoans requires scores of 620 and over to qualify on a VA loan.

To best prepare, homebuyers can take steps to improve their credit score to buy house before they apply for their mortgages. Even small improvements to your credit can significantly boost your borrowing potential and therefore provide access to more preferable loan terms.

Take these requirements on credit score to buy house into account when you’re shopping for your mortgage loan. For more assistance with your purchase, partner with the best real estate agent.