What is Title Insurance and Do I Need it When Buying a Home?

Throughout the course of a real estate purchase, buyers may come across new terms. One of the questions that buyers may have as they’re moving through their transaction is “what is title insurance?” Learning the answer to “what is title insurance” will help buyers understand the important role that title insurance policies play in securing the position of new homeowners. Here is some helpful information to answer what is title insurance [https://www.homeclosing101.org/7-reasons-why-every-ho

Throughout the course of a real estate purchase, buyers may come across new terms. One of the questions that buyers may have as they’re moving through their transaction is “what is title insurance?”

Learning the answer to “what is title insurance” will help buyers understand the important role that title insurance policies play in securing the position of new homeowners.

Here is some helpful information to answer what is title insurance, as well as an explanation of why you will likely need to take out a title insurance policy when buying a new home.

What is Title Insurance?

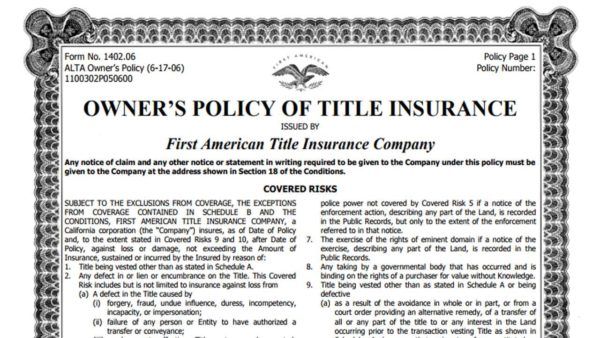

Title insurance policies protect homeowners from being financially responsible for issues related to the property’s official ownership records.

There are two types of title insurance policies. One is for mortgage lenders since lenders require a title insurance policy when issuing mortgage loans.

The other type of title insurance is for the homeowner. Individual homeowners can purchase these policies in addition to the lender’s title insurance, or on its own if the buyer is not using a mortgage to purchase their homes.

Do Buyers Need Title Insurance?

Now that you know what is title insurance, do you need it?

If you are taking out a mortgage loan to finance your home purchase, your lender will require that you open a title insurance policy. Title insurance policies are a mandatory requirement for closing on your mortgage.

Lenders require borrowers to hold title insurance policies to avoid any losses related to issues with the home's ownership records.

Even if you are not working with a lender to fund the purchase of your home, it’s still recommended that you take out a title insurance policy.

Title insurance policies offer buyers an additional layer of protection. In case there is a problem with the home’s title, homeowners will not be responsible for paying out of pocket to resolve the issue. Furthermore, title insurance protects buyers from issues relating to unauthorized actions taken on the property’s title.

Buyers should always err on the side of caution regarding their home’s title and take out title insurance policies, both independently and through their mortgage lenders.

Benefits of Title Insurance

Title insurance reduces the risks of homeownership while protecting your real estate investment.

Homeowners who have active title insurance policies are protected from:

- Fraudulent activity relating to your property title

- Forged transfer of ownership rights in the property

- Mistakes or errors that occurred when filing your title

- Title defects that occurred before you opened your policy

Whatever the potential issue may be, title insurance will protect buyers from facing the potential legal costs if a new or previously undiscovered title defect arises while they own the property.

In the worst-case scenario, title insurance policies protect homeowners from losing their properties due to an unresolved problem on the home’s title record.

Even if the initial title search conducted during the home buying process comes out clean — detecting no issues or problems — homeowners should still protect themselves with title insurance policies to account for missed or future issues.

How Much Does Title Insurance Cost, and How Do You Pay?

Title insurance policies are paid with a one-time payment. Title insurance is not a monthly expense that is paid through your mortgage payments. In most cases, title insurance is bundled into your closing costs and paid at the closing meeting.

The price of title insurance policies will vary depending on the policy you choose and the state your home is located in.

Title insurance policies typically cost between $500 and $4,000.

It’s possible to access additional savings based on your location. For example, if you are buying two title insurance policies — one for the lender and one for the homeowner — some states offer special deals. In Texas, the first title insurance policy is charged at full price while the second policy is only charged for $100.

To learn more about the specific costs of title insurance policies based on your specific location, speak with your agent and mortgage lender.

How to Choose Title Insurance Policies

To help you find the best title insurance policies for your home purchase, reference the American Land Title Association’s full list of title insurers across the country. You will be able to find insurers in your specific city and state using this resource.

If you’re interested in working with an online-based title insurer, you can find online title insurance providers.

To get connected with a top-performing real estate agent in your market to walk you through your home purchase, visit RealEstateAgents.com. If you’re interested in learning more about the home buying process, explore more helpful articles from the RealEstateAgents.com Blog.