What’s the Debt to Income Ratio to Get a Mortgage?

While 43% is typically the maximum debt to income ratio to get a mortgage, lenders prefer a 36% debt to income ratio or lower to qualify for loan benefits.

When you apply for a loan to purchase your home, lenders will be analyzing if you have the appropriate debt to income ratio to get a mortgage. Debt to income ratio, also called a DTI, is one of the ways that lenders determine a buyer’s creditworthiness.

If you’re going to be financing your home purchase, gaining a better understanding of the debt to income ratio to get a mortgage can help you prepare for your loan application by improving your borrowing outlook.

What Is Debt to Income Ratio?

Debt to income ratio is the percentage of your gross monthly income that is used to pay off your monthly debt payments. DTI looks at your income and debts on a monthly basis, allowing lenders to analyze the level of risk you pose as a borrower.

Debt to income ratios determines the balance between debt and income that shapes your finances.

Debt to income ratios are written as percentages — such as 15%, 33%, 50%. The percentage indicates how much of your income pays off outstanding debts. For example, a 25% debt to income ratio means that 25% of your gross monthly income is used to pay back debts each month.

Low Debt to Income Ratios

Low debt to income ratios demonstrates a borrower that has the ability to use their stream of income to pay off new debts. Borrowers with a low debt to income ratio have greater financial bandwidth since less of their liquid funds are spent on paying off outstanding debts each month.

High Debt to Income Ratios

On the other hand, high debt-to-income ratios mean that more of your monthly income is used to pay off existing debts. Borrowers with high debt to income ratios likely have less liquid cash to put toward payments for their new loans — signaling a greater risk to lenders.

What is a Good Debt to Income Ratio?

According to Wells Fargo, these are the debt-to-income standards maintained to consider the applications of borrowers.

35% or Less: Good Debt to Income Ratio

If 35% or less of your gross monthly income is used to pay off existing debts, lenders will view your debts at a manageable level. The lower the DTI, the more favorable a debt-to-income ratio is to lenders.

36% to 49%: Fair Debt to Income Ratio

If between 36% and 49% of your income is being used to pay off debts, you have the opportunity to improve your finances. Fair debt to income ratios indicate that your debt is managed, but reducing what you owe will give you more control over your finances.

50% or More: Poor Debt to Income Ratio

When more than half of your income is going to paying off existing debts, you likely will not have the opportunity to save or invest in new payments. Poor debt to income ratios will likely limit your ability to gain access to favorable loan opportunities from your lender.

Debt to Income Ratio To Get a Mortgage

When analyzing a homebuyer’s creditworthiness, lenders prefer a low debt to income ratio to get a mortgage.

Low debt to credit ratios indicate that a buyer will be able to manage their mortgage payments, while high debt to income ratios can suggest that a buyer would be more likely to default on their loans.

Generally, most lenders maintain a maximum 43% debt to income ratio to get a mortgage. Borrowers with debt to income ratios that are higher than 43% may not be able to get approved for a mortgage.

Lenders prefer debt to income ratios that are lower than 36% — with no more than 28% of that total DTI going toward a mortgage for current homeowners or rent payment for renters. That means that your total debt payments outside of your mortgage or rent should not exceed 8% of your gross income.

How to Calculate Your Debt to Income Ratio

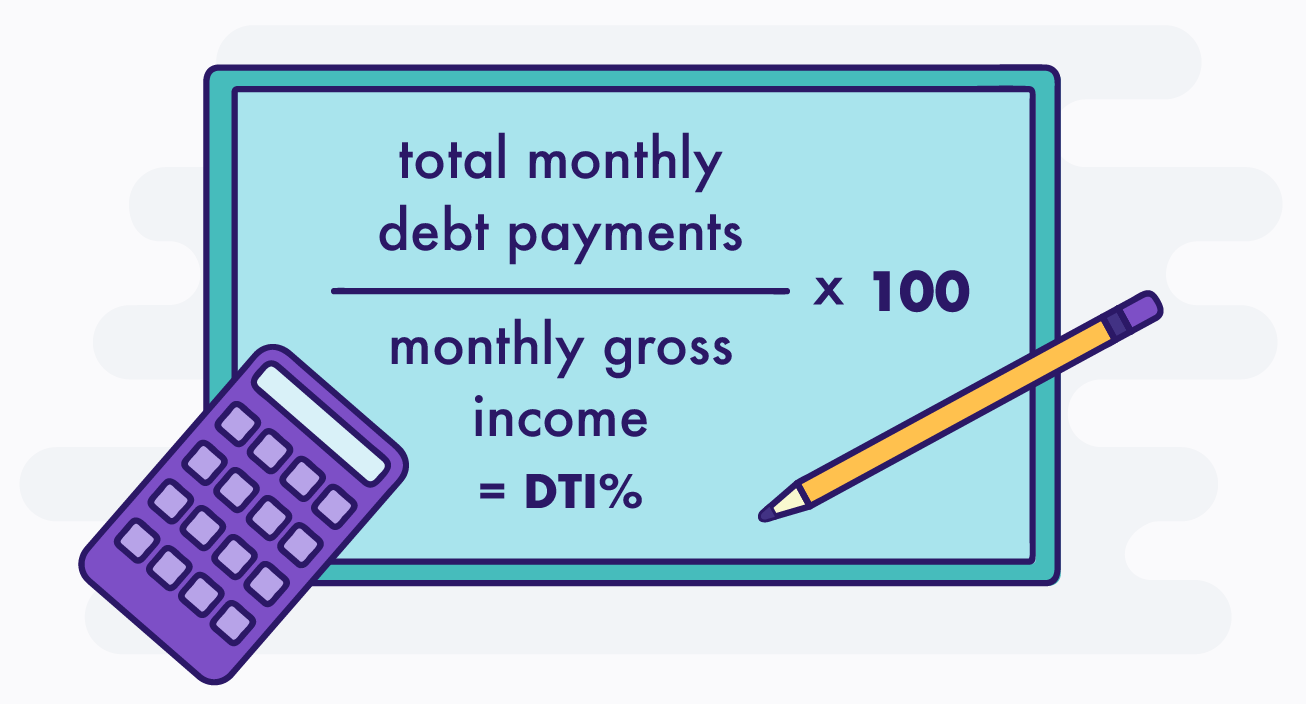

To help you prepare your debt to income ratio to get a mortgage, here is an equation to calculate your debt to income ratio.

Debt to Income Ratio =

(Total of Monthly Debt Payments) / (Gross Monthly Income)

To determine your debt to income ratio, simply divide the amount you pay each month in debt by your total gross monthly income. The sum will be a decimal, so multiply the total by 100 to convert your DTI into a percentage.

Calculating your debt to income ratio in advance can help you understand how mortgage lenders will view your loan application.

If you have specific questions regarding your debt to income ratio to get a mortgage, consult your financial advisor, mortgage lender, or real estate agent.

For more helpful homebuyers tips and information, explore more articles on the RealEstateAgents.com Blog.