Which Cities Have the Highest and Lowest Property Taxes in the United States?

If you own a home or commercial property, you know that property taxes can be an expensive part of the package. Although often a big expense, property taxes help pay for municipal services like street maintenance, sanitation, police, libraries, and more. Some cities in the United States pay considerably more in property taxes than others. Do you know which cities have the lowest and highest property taxes in the U.S.? The researchers at RealEstateAgents.com looked at property tax data from the

If you own a home or commercial property, you know that property taxes can be an expensive part of the package. Although often a big expense, property taxes help pay for municipal services like street maintenance, sanitation, police, libraries, and more. Some cities in the United States pay considerably more in property taxes than others. Do you know which cities have the lowest and highest property taxes in the U.S.?

The researchers at RealEstateAgents.com looked at property tax data from the U.S. Census Bureau to determine which cities have the highest property taxes in the country. See which cities top the list!

Copy and paste the following code to embed this image on your page:

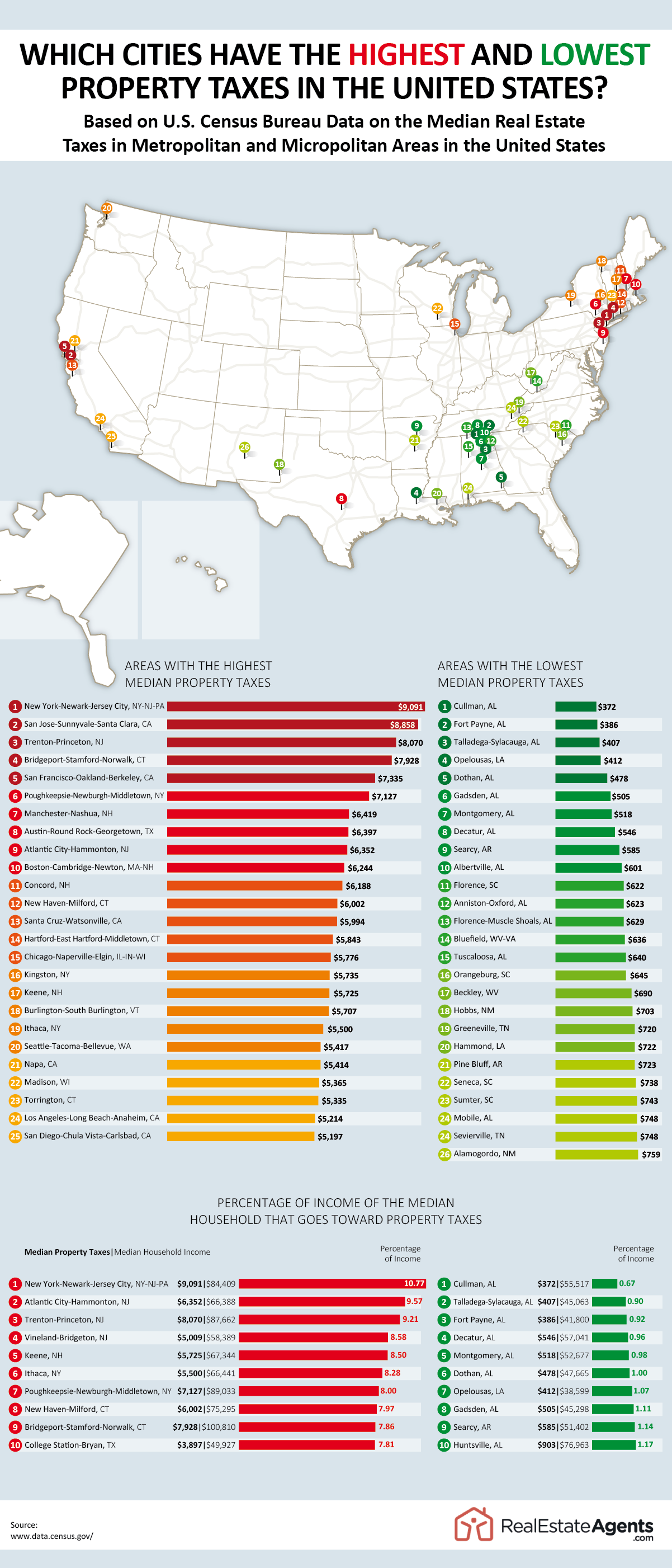

Cities With the Highest Property Taxes

The place with the highest median property taxes is the New York City metro area, which includes Newark and Jersey City in New Jersey. The median property taxes in this area are $9,091. Many of the homes and other properties in New York City have high values, which drives up the property tax bills.

The next city on the list is San Jose, CA. The median property taxes in this area (which includes Sunnyvale and Santa Clara) are $8,858. San Jose is one of the main cities in Silicon Valley, making it a destination for many people hoping to gain employment in the tech sector. Because of this, San Jose properties are priced at a premium and property taxes are high as well.

Coming in third is the Trenton-Princeton area in New Jersey, where property taxes have a median price of $8,070. In addition to Ivy League institution Princeton University, Princeton is also home to many historic buildings and homes.

In fourth place is Bridgeport-Stamford-Norwalk, CT. The median property taxes in the area are $7,928. Stamford is a popular location due to its close location to New York City, making it an in-demand place for commuters. This also means that property prices and property taxes are on the high end in the United States.

Wondering about San Francisco property tax rates? San Francisco ranks fifth on the list. The median property taxes are $7,335. The San Francisco metro area (which includes Oakland and Berkeley) is also located in Silicon Valley, making it a popular place for people with jobs in the tech industry.

Which Cities Have the Lowest Property Taxes?

While the cities above are known for their incredibly high property taxes, the next group of cities have the lowest property taxes in the country. The majority of these cities are located in the Southeast United States. The city with the lowest property taxes is Cullman, AL. This place, located about 50 miles north of Birmingham, has a median property tax of just $372. Second on the list is another Alabama town: Fort Payne. This city is located in northeastern Alabama, and the median property taxes are $386. The third area on the list is Talladega-Sylacauga, AL. It is located 50 miles east of Birmingham, and the median property taxes are $407.

In addition to some of these cities’ property taxes being very affordable, they are also low when compared to the median salary in the area. For instance, not only are property taxes in Cullman, AL, the lowest in the country, but they also only make up only 0.67% of the median salary of residents in the area. In comparison, for those who own homes in New York City, property taxes make up 10.77% of their median salary.

Why Do We Pay Property Taxes?

Property taxes are a very important part of maintaining communities. While the division of property tax collections will vary from state to state, the way property taxes are determined is fairly standard. The amount property owners owe is calculated by taking the property tax rate and multiplying it by the value of the building or land in question. This typically gets reassessed yearly.

Some of the things that property taxes could be used for include:

- Funding law enforcement and fire protection in the community

- Ensuring clean water and proper sanitation

- Paying for road repairs and funding the construction of new roads and highways

- Providing financial support to public schools and libraries

While some people may balk at high property taxes, it’s important to remember that the money goes back into supporting the community and giving local governments the resources they need to protect and assist their residents.

Areas With the Highest Median Property Taxes

|

Rank |

Area |

Median Property Taxes |

|---|---|---|

|

1 |

New York-Newark-Jersey City, NY-NJ |

$9,091 |

|

2 |

San Jose-Sunnyvale-Santa Clara, CA |

$8,858 |

|

3 |

Trenton-Princeton, NJ |

$8,070 |

|

4 |

Bridgeport-Stamford-Norwalk, CT |

$7,928 |

|

5 |

San Francisco-Oakland-Berkeley, CA |

$7,335 |

|

6 |

Poughkeepsie-Newburgh-Middletown, NY |

$7,127 |

|

7 |

Manchester-Nashua, NH |

$6,419 |

|

8 |

Austin-Round Rock-Georgetown, TX |

$6,397 |

|

9 |

Atlantic City-Hammonton, NJ |

$6,352 |

|

10 |

Boston-Cambridge-Newton, MA |

$6,244 |

|

11 |

Concord, NH |

$6,188 |

|

12 |

New Haven-Milford, CT |

$6,002 |

|

13 |

Santa Cruz-Watsonville, CA |

$5,994 |

|

14 |

Hartford-East Hartford-Middletown, CT |

$5,843 |

|

15 |

Chicago-Naperville-Elgin, IL |

$5,776 |

|

16 |

Kingston, NY |

$5,735 |

|

17 |

Keene, NH |

$5,725 |

|

18 |

Burlington-South Burlington, VT |

$5,707 |

|

19 |

Ithaca, NY |

$5,500 |

|

20 |

Seattle-Tacoma-Bellevue, WA |

$5,417 |

|

21 |

Napa, CA |

$5,414 |

|

22 |

Madison, WI |

$5,365 |

|

23 |

Torrington, CT |

$5,335 |

|

24 |

Los Angeles-Long Beach-Anaheim, CA |

$5,214 |

|

25 |

San Diego-Chula Vista-Carlsbad, CA |

$5,197 |

Areas With the Lowest Median Property Taxes

|

Rank |

Area |

Median Property Taxes |

|---|---|---|

|

1 |

Cullman, AL |

$372 |

|

2 |

Fort Payne, AL |

$386 |

|

3 |

Talladega-Sylacauga, AL |

$407 |

|

4 |

Opelousas, LA |

$412 |

|

5 |

Dothan, AL |

$478 |

|

6 |

Gadsden, AL |

$505 |

|

7 |

Montgomery, AL |

$518 |

|

8 |

Decatur, AL |

$546 |

|

9 |

Searcy, AR |

$585 |

|

10 |

Albertville, AL |

$601 |

|

11 |

Florence, SC |

$622 |

|

12 |

Anniston-Oxford, AL |

$623 |

|

13 |

Florence-Muscle Shoals, AL |

$629 |

|

14 |

Bluefield, WV |

$636 |

|

15 |

Tuscaloosa, AL |

$640 |

|

16 |

Orangeburg, SC |

$645 |

|

17 |

Beckley, WV |

$690 |

|

18 |

Hobbs, NM |

$703 |

|

19 |

Greeneville, TN |

$720 |

|

20 |

Hammond, LA |

$722 |

|

21 |

Pine Bluff, AR |

$723 |

|

22 |

Seneca, SC |

$738 |

|

23 |

Sumter, SC |

$743 |

|

24 |

Mobile, AL |

$748 |

|

24 |

Sevierville, TN |

$748 |

|

26 |

Alamogordo, NM |

$759 |

Percentage of Income of the Median Household That Goes Toward Property Taxes

Highest Percentage of Income

|

Rank |

Area |

Median Property Taxes |

Median Household Income |

Percentage of Income That Goes Toward Property Taxes |

|---|---|---|---|---|

|

1 |

New York-Newark-Jersey City, NY-NJ |

$9,091 |

$84,409 |

10.77% |

|

2 |

Atlantic City-Hammonton, NJ |

$6,352 |

$66,388 |

9.57% |

|

3 |

Trenton-Princeton, NJ |

$8,070 |

$87,662 |

9.21% |

|

4 |

Vineland-Bridgeton, NJ |

$5,009 |

$58,389 |

8.58% |

|

5 |

Keene, NH |

$5,725 |

$67,344 |

8.50% |

|

6 |

Ithaca, NY |

$5,500 |

$66,441 |

8.28% |

|

7 |

Poughkeepsie-Newburgh-Middletown, NY |

$7,127 |

$89,033 |

8.00% |

|

8 |

New Haven-Milford, CT |

$6,002 |

$75,295 |

7.97% |

|

9 |

Bridgeport-Stamford-Norwalk, CT |

$7,928 |

$100,810 |

7.86% |

|

10 |

College Station-Bryan, TX |

$3,897 |

$49,927 |

7.81% |

Lowest Percentage of Income

|

Rank |

Area |

Median Property Taxes |

Median Household Income |

Percentage of Income That Goes Toward Property Taxes |

|---|---|---|---|---|

|

1 |

Cullman, AL |

$372 |

$55,517 |

0.67% |

|

2 |

Talladega-Sylacauga, AL |

$407 |

$45,063 |

0.90% |

|

3 |

Fort Payne, AL |

$386 |

$41,800 |

0.92% |

|

4 |

Decatur, AL |

$546 |

$57,041 |

0.96% |

|

5 |

Montgomery, AL |

$518 |

$52,677 |

0.98% |

|

6 |

Dothan, AL |

$478 |

$47,665 |

1.00% |

|

7 |

Opelousas, LA |

$412 |

$38,599 |

1.07% |

|

8 |

Gadsden, AL |

$505 |

$45,298 |

1.11% |

|

9 |

Searcy, AR |

$585 |

$51,402 |

1.14% |

|

10 |

Huntsville, AL |

$903 |

$76,963 |

1.17% |