How is Your Credit Score Calculated?

Answering “how is your credit score calculated?” can help homebuyers prepare to apply for a mortgage to finance their property purchase.

How is your credit score calculated? Understanding how your credit score is calculated can help buyers prepare for their mortgage applications. This is a crucial step in establishing a larger home buying strategy as credit scores directly relate to the long-term affordability of your home.

Borrowers that do not have high enough credit scores will not get a loan with the best mortgage rates available. Mortgage lenders determine a borrower’s likelihood of paying back their loan by their credit score. As a result, low scores merit higher interest rates and insurance policies to secure the lender’s investment.

Your Credit Score Impacts How Much You Pay For Your Mortgage

In May 2021, NAR® reported that the median price for a home in the United States was $350,300.

When a borrower with a 785 FICO credit score applied for a 30-year fixed mortgage to purchase a $350,300 home with a 20% down payment, they received a 2.9% interest rate. Based on their original loan amount of $280,240, they would pay $141,739 in total additional interest throughout the lifetime of the loan.

The same loan taken out by a borrower with a 680 credit score may receive a higher interest rate of 3.6%. With no other changes to the loan, this borrower would end up paying $172,790 in total interest on the same principal amount.

That 0.7% increase in interest would result in the buyer paying an additional $31,051 on their mortgage over the course of 30 years.

Buyers who are seeking the most financially efficient home purchase can benefit from building their credit score before they apply for their loan. Based on the previous example, doing so can save them tens of thousands of dollars in the long run.

Benefits of Applying for a Mortgage with a Higher Credit Score

Mortgage applicants with satisfactory credit scores typically gain access to preferable mortgage terms, such as:

- Lower interest rates

- Reduced fees and securities

- A more affordable home loan

In order to make tangible improvements to your credit score to prepare for the mortgage application process, borrowers need to understand how their credit score is determined.

Here is an overview explaining the formula used to determine your credit score calculated.

Credit Score Calculated: Here’s the Formula

Your FICO credit score is the system used by lenders to determine your mortgage qualifications.

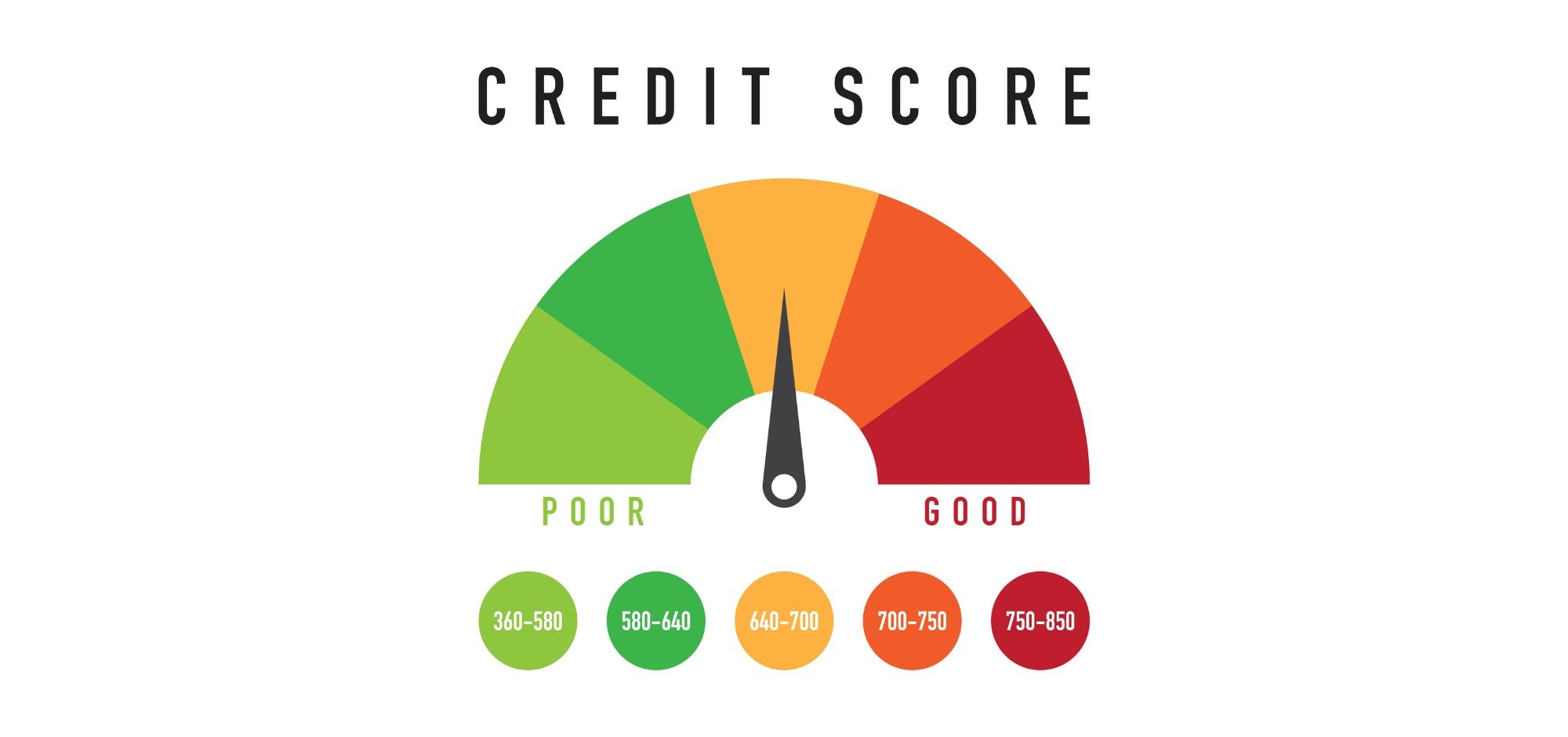

FICO scores range between poor credit below 620 and excellent credit above 740 with the highest possible score being 850. The different ratings of credit scores are:

- Excellent Credit — 740 to 850

- Good Credit — 700 to 739

- Fair Credit — 630 to 699

- Poor Credit — 620 and below

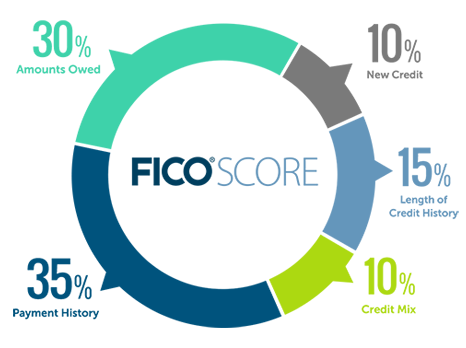

Your FICO credit score is calculated by combining a mix of credit data from your personal credit report. Five major categories of credit are reviewed to establish your FICO credit score. Here is an overview of each category:

#1. Payment History (35%)

Your payment history outlines the timeliness with which you’ve paid your past and existing credit accounts. This is the most important variable that shapes your credit score as it’s a major indicator of how you will likely approach repayment of any new accounts, including your mortgage.

#2. Amounts Owed (30%)

Having amounts owed to other credit accounts does not necessarily mean that your credit score will be lowered. However, this category of information takes into account how much of your available credit you are using. This is where the debt-to-credit ratio appears in your FICO score.

If you are using high amounts of your available credit without paying it off, it tells lenders that you are likely overextended. In these cases, your credit score will likely be lowered.

#3. Length of Credit History (15%)

Having a longer credit history is beneficial for your credit score. FICO looks at how long your total credit accounts have been established, how long specific accounts have been active, and how long it has been since you’ve used specific accounts.

#4. Credit Mix (10%)

The different types of accounts you have open are determined by the credit mix portion of your FICO score’s calculation.

Items such as credit cards, loans, and installment accounts are weighed to consider your total mix of credit.

#5. New Credit (10%)

Opening new credit accounts can reduce your credit score as it insinuates you need more financial leverage and therefore are at a higher risk for repayment.

Tips for Building Your Credit Score

Now that you understand your credit score calculated, you can use that information to improve your creditworthiness to gain access to preferable mortgage terms. Here are five strategies to build your credit score.

- Pay off existing debts.

- Make all bill payments on or ahead of time.

- Avoid opening up multiple new credit lines in a short period of time.

- Reduce credit card usage.

- Use all of your credit accounts responsibly.

Having relevant mortgage-related information and understanding the home buying process is integral to making this major life decision a positive experience. One of the most important steps, selecting the right real estate professional to work with, is part of that decision. Let us help you select and get connected with the right agent today.