What Credit Score Do You Need to Get a Mortgage?

What credit score do you need to get a mortgage? There are flexible loan options available for almost all credit scores.

If you’re going to be buying a home funded by a mortgage loan, one of the first questions that buyers should ask is “what credit score do you need to get a mortgage?”

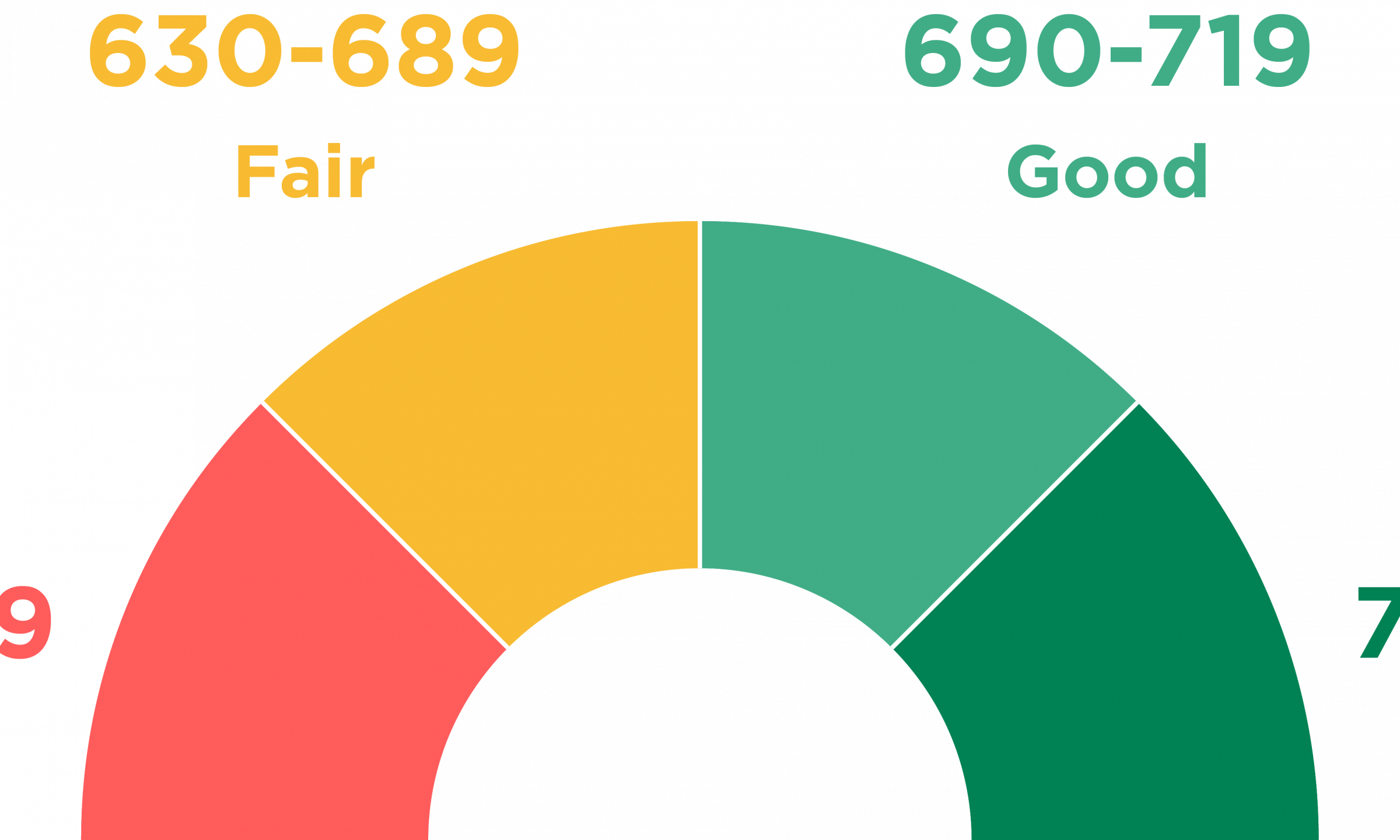

Understanding how your credit score influences which loan options you qualify for will help buyers better understand what their prospective outlook will be as they begin talking to lenders and shopping for their loans.

What Credit Score Do You Need to Get a Mortgage?

What credit score do you need to get a mortgage? The answer fully depends on which type of loan you are applying for.

Each loan type maintains its own qualifying standards to determine which borrowers are eligible for the mortgage.

That means that buyers with low credit scores are still able to qualify for mortgage loan options even if their credit scores are not where they’d like them to be.

In some cases, these loans may reduce the credit score requirements and instead apply additional measures to secure the loan. For example, lenders may require that a borrower with a lower score purchases a private mortgage insurance (PMI) policy or increase the down payment amount.

However, certain government-backed loans meant to make homeownership more accessible for lower-income buyers may not include these additional protective measures when reducing the credit score requirements.

It’s important for buyers to understand the various loan options available when they are searching for their mortgages.

To help buyers understand the answer to “what credit score do you need to get a mortgage?” here is an overview of various loan packages and their credit score requirements.

Credit Score Minimums for FHA Loans

Loans backed by the FHA, or the Federal Housing Administration, are designed to make homeownership accessible to qualifying buyers with mid-to-low credit scores.

The minimum credit score required to obtain an FHA loan is 500. Buyers with credit scores between 500 to 579 are required to put at least 10% down on their new homes. Borrowers applying with credit scores of 580 and above may be eligible for a down payment of as low as 3.5%.

Borrowers can find FHA loans from banks, traditional lenders, and credit unions.

Credit Score Minimums for VA Loans

Loans backed by the VA, or the US Department of Veterans Affairs, are designed to help military members and their families gain access to homeownership opportunities.

The minimum credit score required to obtain a VA loan is typically 580. However, VA lenders may be able to adjust the credit score requirements applied to their loans. Speak to your lender for specific information regarding their VA loans.

VA loans do not require borrowers to take out PMI policies or put down any down payment. However, lenders may charge a one-time funding fee that is a percentage of the property’s purchasing price. These funding fees do not apply to veterans that receive disability from the VA. Borrowers that submit down payments are able to reduce the cost of the one-time funding fee.

Credit Score Minimums for USDA Loans

Loans backed by the USDA, or the US Department of Agriculture, are designed to help homebuyers in low-income suburban and rural areas access affordable housing.

The minimum credit score required to obtain a USDA loan is usually between 620 and 640. Speak to your lender to learn whether or not a score below 640 can qualify for a USDA loan.

Credit Score Minimums for Conventional Loans

Conventional mortgages are not insured by external government agencies. These conventional loans abide by the industry standards set by Fannie Mae and Freddie Mac.

Typically, lenders maintain a 620 credit score minimum on conventional loans. With conventional loans, higher credit scores give borrowers access to preferable mortgage terms, including lower interest rates and waived fees.

Work With a Top Agent to Help Secure Funding

If you’re having trouble obtaining financing for your new home, speak to your top agent.

When you work with the best agents in your area, they should be able to provide you with specific guidance regarding your mortgage. Agents that are experienced in your local market will be able to share helpful resources or point you in the direction of a reputable and trustworthy lender in your area.

Or, your top agent may be able to recommend tips to help you improve your current score before applying for your mortgage to help you gain access to preferable terms.

To learn more about the home buying process and answer questions like “what credit score do you need to get a mortgage,” click here for more articles from RealEstateAgents.com.