How to Get a Mortgage Pre-Approval

What is a mortgage pre-approval, and how do you get one? Learn how to prove your strength as a buyer with a mortgage pre-approval.

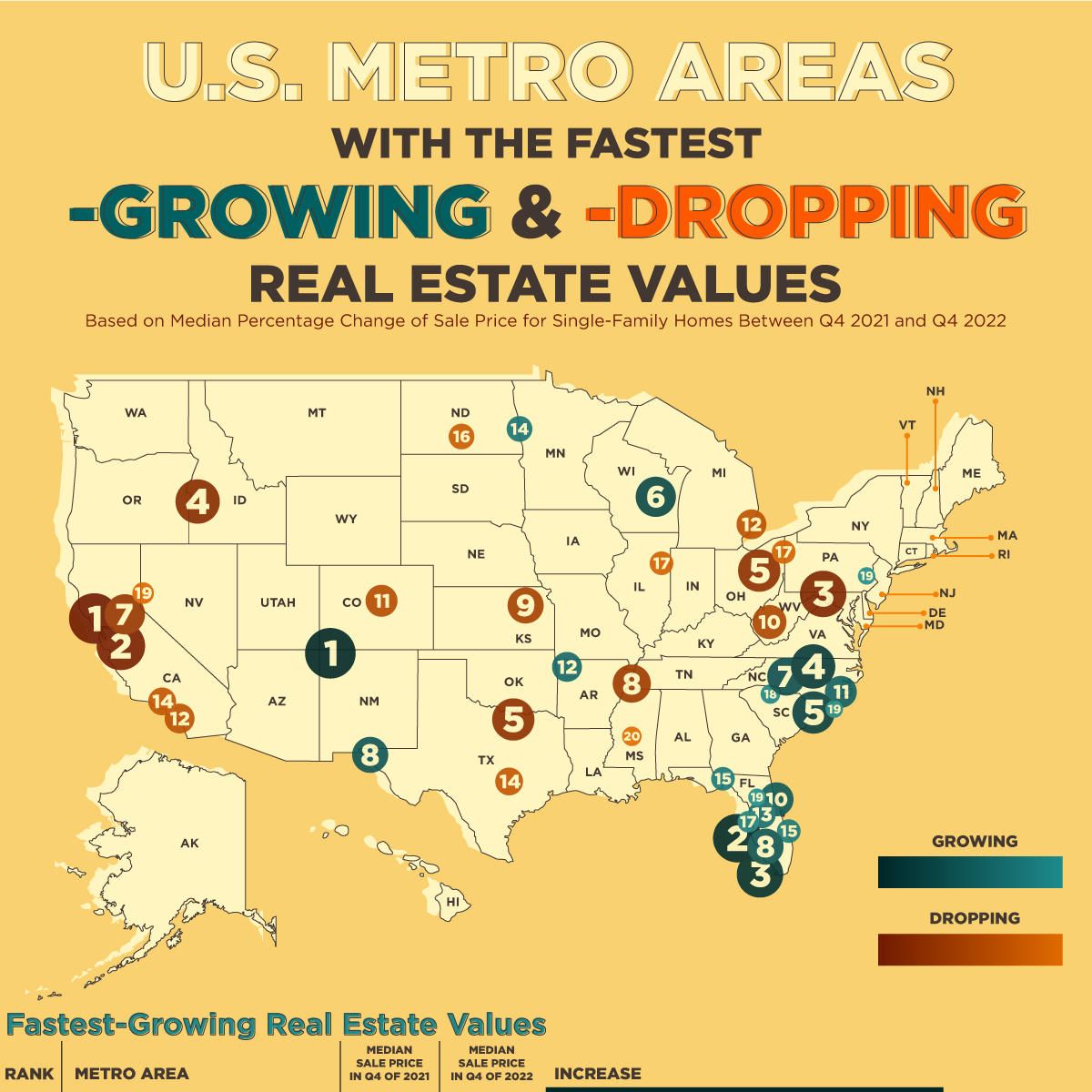

U.S. Cities With the Fastest Growing and Dropping Real Estate Values

Since the beginning of the COVID-19 pandemic, home prices have been fluctuating nonstop. With many employees transitioning to remote work, people suddenly were able to move to different parts of the country, as they no longer had to worry about living near their office. Some opted to move out of major cities to the suburbs, and others chose to buy homes near beaches and in locales with warmer temperatures. Because of this, some U.S. home prices have skyrocketed, while others have been rapidly de

5 Steps to Purchasing Your Very First Home

Finding the right agent, reviewing your finances, and identifying your target market are a few steps you’ll be taking when purchasing your first home.

Do Home Buyers Pay Agent Fees?

In a real estate transaction, it’s customary for the seller to pay the commissions of both their listing agent and the buyer’s agent.

The Pros and Cons of Renting to Own

If you’re looking to test drive your next home, you’ll want to know about all of the pros and cons of renting to own.

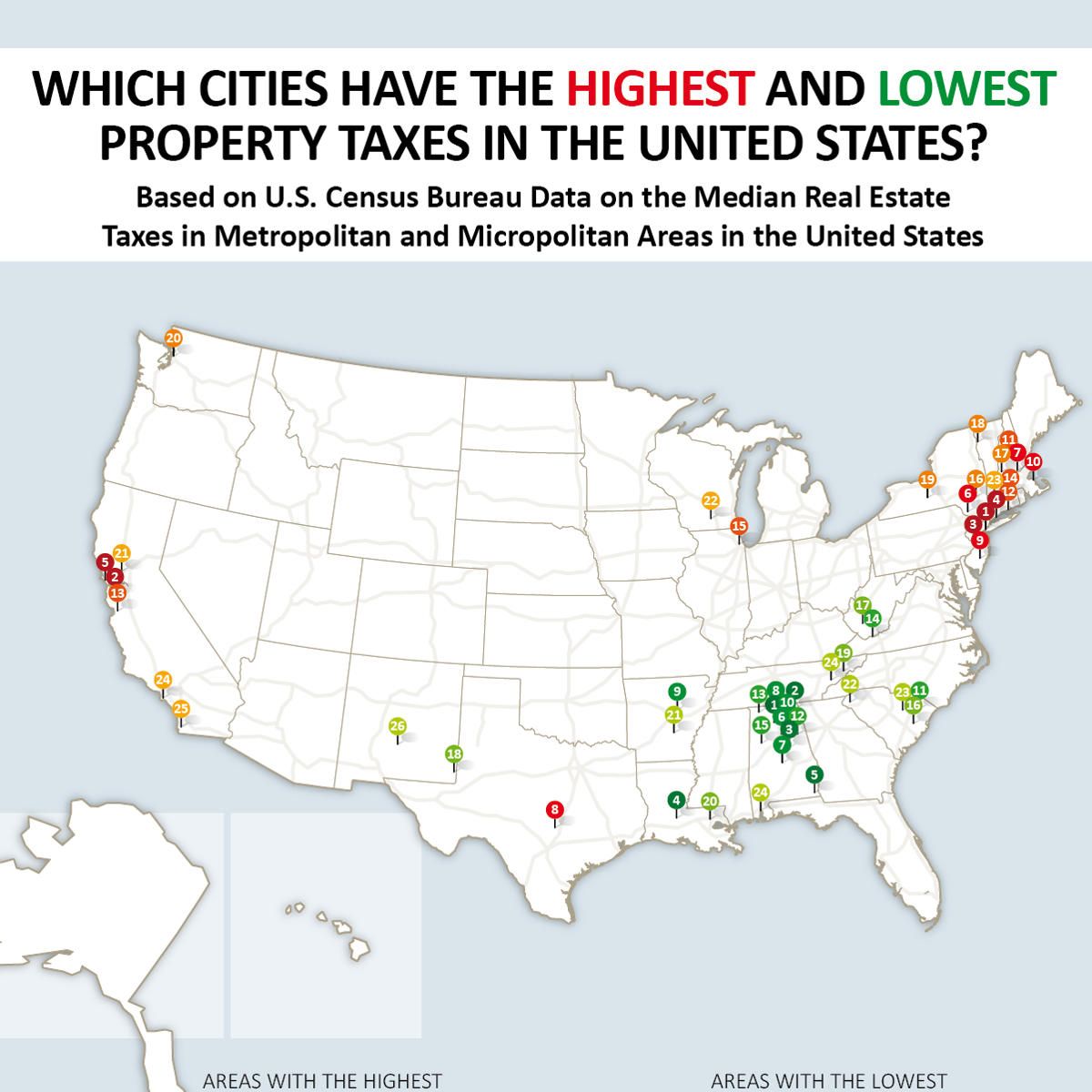

Which Cities Have the Highest and Lowest Property Taxes in the United States?

If you own a home or commercial property, you know that property taxes can be an expensive part of the package. Although often a big expense, property taxes help pay for municipal services like street maintenance, sanitation, police, libraries, and more. Some cities in the United States pay considerably more in property taxes than others. Do you know which cities have the lowest and highest property taxes in the U.S.? The researchers at RealEstateAgents.com looked at property tax data from the

What is a Buyer's Broker Agreement and Do Buyers Need One?

A buyer’s broker agreement is a formal service contract between a homebuyer and a real estate professional outlining responsibilities and expectations.

How Do Rising Interest Rates Impact Your Mortgage Payment?

A slight increase in your mortgage interest rate can significantly increase your mortgage payment amount. Here’s what you need to know.

What Does it Mean to Buy Down Your Mortgage Rate?

When you buy down your mortgage rate, you have the chance to access reduced interest on your loan.

Who Pays a Real Estate Agent When Buying a Home?

When buying a home, the seller typically pays both the listing agent and the buyer’s agent.

Buying a House Out of State? 4 Things to Consider First

If you’re going to be buying a house out of state, make sure that you’re working with a reputable top agent in your new community.

Condo vs. Townhome: What's the Big Difference?

Curious about condo vs townhome? A condo is a unit in a larger property, and a townhome refers to a single-family home sharing walls with another home.

Contingent vs. Under Contract: What's the Difference?

What’s the difference between contingent vs under contract? Contingent means buyers and sellers can back out of the deal if certain terms are not met.

How Much Cash Should You Put Towards a Home Down Payment?

For a home down payment, it’s generally best to put down at least 20%. But, this standard is not a requirement and it’s possible to put down less than 20%.

What is a Good Credit Score for a First-Time Homebuyer?

What is a good credit score to buy a home? Ranging between 650 and 850 is optimum, but it is possible to secure a good deal with a score below 620.